The Board of Trustees (BOT) of UNF will create a subcommittee to decide whether or not UNF should have a policy about socially responsible investments, and if so, what that policy should be.

Radford Lovett, member of both the BOT and Foundation, said the subcommittee is going to make a recommendation at the May 22 meeting based on what their findings are.

Lovett said, “I do think it makes sense likely that we should have a policy here to address those concerns.”

UNF president John Delaney said the UNF Foundation has already decided a neutral policy is a healthier policy. The policy was approved by the Foundation Board on June 4, 2013, said Shari Shuman, Foundation Treasurer.

This means the Foundation does not determine whether or not investments are socially responsible, said Shuman in a previous interview with the Spinnaker.

The Foundation is a nonprofit, tax-exempt organization responsible for collecting donations intended to give UNF financial support. Donated money is passed on to the Perella Weinberg Partners investment firm. The bulk of investment returns are used for scholarship support for students, Delaney said.

“It’s difficult to kind of parse out [where the money is invested] because sometimes you’re really turning money over to a manager and the manager is doing the investing for you,” he said. “They’re not all publicly traded stocks, they may be private companies etc. and they may be huge conglomerates that may have an investment in what the Divest [UNF] group is particularly focused on.”

He said the Foundation has more long term investments, and the BOT has more short term investments.

Delaney said both the existing Foundation policy and the soon-to-be-created BOT policy are in response to Divest UNF, a student led organization urging the university to freeze new investments in fossil fuel companies and stop investing in companies involved with fossil fuels within the next five years. He said they presented to both the Foundation and the BOT.

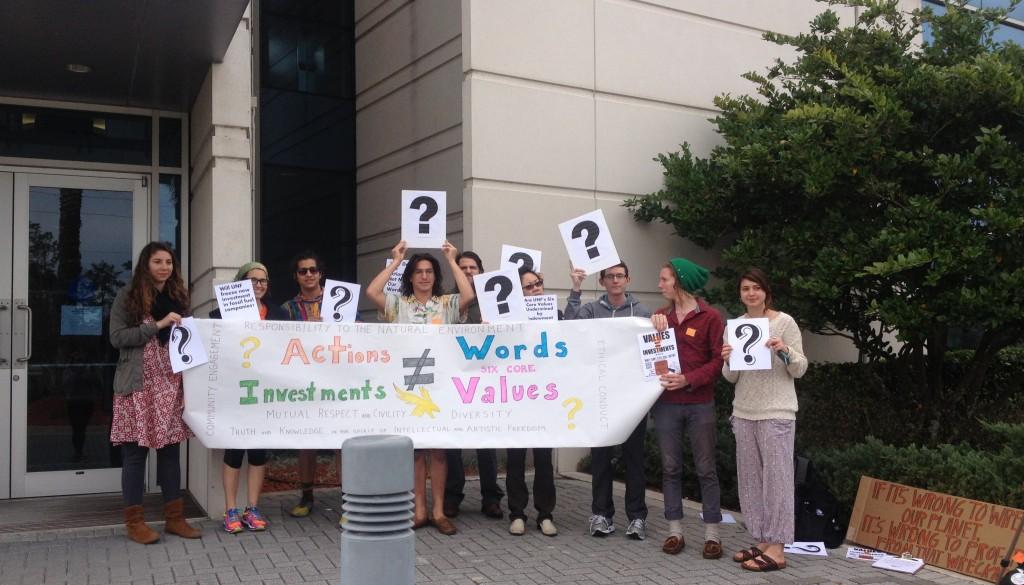

Photo by Saphara Harrell

Divest UNF also staged a protest Feb. 27 outside of a Foundation Executive Committee Meeting.

He said he has a lot of respect for what they’re conveying.

Delaney said if the Foundation is investing in fossil fuels, the university would still be showing responsibility to the natural environment as one of its six core values. He said he doesn’t think it’s socially irresponsible to invest in fossil fuels.

He said the UNF Foundation and the BOT aren’t going to have the same investment policy because the foundation does not report to the BOT.

“They’re like two different companies if you want to think of it that way,” Delaney said. “They can set their own rules and their own regulations.”

Tom Serwatka, Vice President and Chief of Staff, said it’s necessary for UNF and the Foundation to be separate entities because of tax laws and other statutes.

The Foundation is a separately incorporated 501(c)(3) organization. The Foundation is tax-exempt because it is considered a charitable organization.

Serwatka said the UNF Foundation is an independent organization connected to UNF.

He said Delaney can set up certain parameters in which the foundation can operate.

If the BOT establishes a policy about socially responsible investing, Serwatka said Delaney could take it to the Foundation about accepting that policy.

“[Delaney] carries a lot of weight with the Foundation.”

Serwatka said if the BOT decides to create a policy concerning socially responsible investing, it shouldn’t apply to the Foundation because they can make their own decisions.

Delaney said, “[The Foundation] believes that you’re often going to find conflicts. For example, there’s a group that says ‘don’t invest in fossil fuels’, there’s another group that says ‘don’t invest in nuclear, don’t invest in hydroelectric, don’t invest in wind power because it kills birds.’ So, how are you going to pick?”

Serwatka said he thinks the university’s six core values should apply to investing, but the Foundation doesn’t have to abide by those six core values.

He said the Foundation decided to have a neutral policy for itself because corporate boards always create their own rules.

Though he didn’t know why the Foundation and UNF should have separate policies, Serwatka said, “I can tell you that they can.”

Email Blake Middleton at [email protected]